'Oberoi Group has taken all necessary approvals from the Government of India in relation to the Amex Group/Oberoi Group joint venture...' — P R S Oberoi

The Indian Express, 8 April, 2016

In 2010, The Oberoi Group announced it had acquired 45.8 per cent stake from Amex Investment Ltd (Hong Kong) in their joint venture EIH Holdings Ltd (British Virgin Islands) that manages and invests in hotels outside India. The deal was struck through EIH International Limited (BVI) for US $ 45 million.

International law firm Mossack Fonseca records and an investigation by

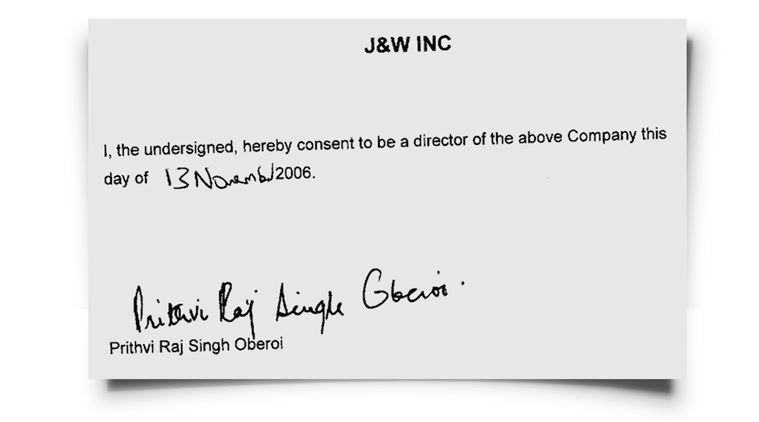

The Indian Express show that another joint venture with Amex, J&W Inc (Bahamas), was acquired by one Peran Limited (Hong Kong) in 2010. J&W Inc (Bahamas) already had Oberoi Group’s P R S Oberoi and Deepak Madhok as directors.

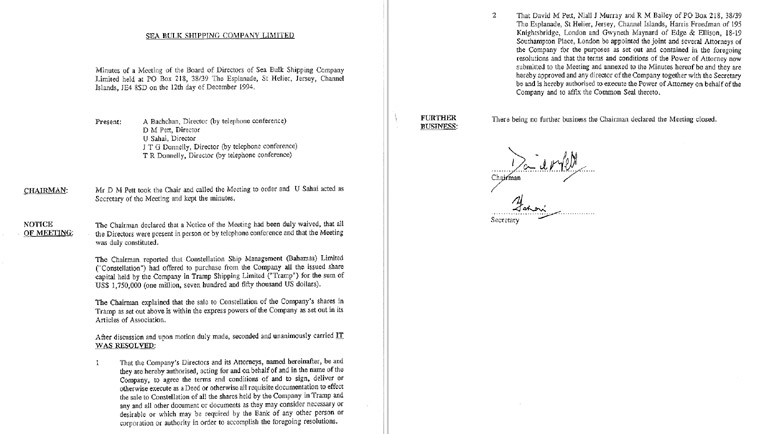

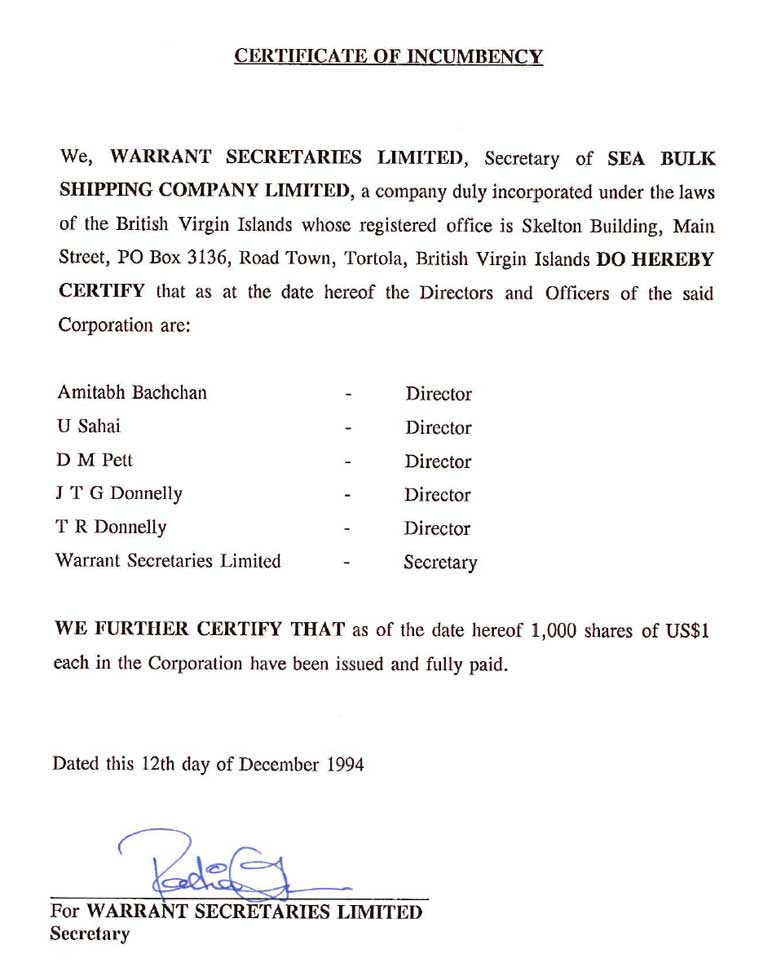

Mossack Fonseca document.

Mossack Fonseca document.

Pathmanaban Selvadurai, who is director of at least three EIH companies, is also director of Peran Limited (Hong Kong). Mossack Fonseca records show that the company’s original certificate of J&W Inc share was sent to Sudarshan Rao, vice president (finance) of the Oberoi Group, in 2011.

While the EIH Limited, the flagship company of the Oberoi Group, does not include J&W Inc (Bahamas) on the list of its many subsidiaries, it does include a similarly named company: J&W Hong Kong Limited. The company was incorporated in Hong Kong on September 26, 2006, a couple of months before the Oberoi Group entered J&W Inc (Bahamas).

Amex had stake in J&W Hong Kong Limited which, soon after incorporation, bought shares in EIH Holdings Ltd (BVI), the joint venture the Oberoi Group acquired from Amex in 2010. The Oberoi Group declined to discuss the ownership of Peran Limited (Hong Kong) and whether the acquisition of Amex stake in EIH Holdings also included the takeover of J&W Hong Kong and J&W Inc (Bahamas).

In an email response, P R S Oberoi, executive chairman of the Oberoi Group, said: “The business affairs of Amex Group/Oberoi Group joint venture are confidential and the parties are legally bound not to disclose or discuss those matters with third parties.” (See response below)

J&W Inc belonged to Kul Rattan Chadha, Indian-born Dutch businessman of MEXX fashion and CitizenM hotel chain fame and controller of Amex Investments. Until 2006, Chadha’s partner was Indian hotelier Jayant Nanda through his Panama company Richmond Enterprises SA.

Five months after Nanda’s exit, the Oberoi Group entered the picture. Peran Limited (Hong Kong), Mossack Fonseca records show, acquired 100 per cent stake in J&W Inc from Chadha’s Amex through two transfers of 49 per cent and 51per cent in November 2006 and July 2010, respectively.

In November 2006, Mossack Fonseca records show, Oberoi and Madhok were appointed directors and J&W Inc executed a debt waiver agreement with Amex Investment Limited, providing a reduction in an unspecified debt owed by the company to US $ 9,999,999 and issued promissory notes to Amex for the amount. The same day, Amex moved 490 of its 1,000 shares to Peran Limited (Hong Kong).

Deepak Madhok of the Oberoi Group signed on behalf of both Peran and J&W Inc.

On June 30, 2010, Chadha, along with the other Amex representative Nicolaas Peter van Lookeren Campagne, resigned from EIH Holdings (BVI), J&W Hong Kong Ltd and also J&W Inc. The next day, Mossack Fonseca records show, Amex transferred its remaining 510 shares of J&W Inc to Peran Limited. The purchase price was fixed at US $13.34 million which was then reduced to US $11.70 million.

Peran, Mossack Fonseca records show, paid only $ 4.33 million after setting off the rest against the amount owed by Amex to Peran under a “deed of set off between Amex, Peran and Oberoi Holdings Hong Kong Limited” and purchase of 13 preference shares by Amex from Peran in Oberoi Holdings Hong Kong Limited.

Incorporated in 1989, Oberoi Holdings Hong Kong Ltd is described on the BSE website (bseindia.com) as a subsidiary of Oberoi Hotels Pvt Ltd through which the latter entered into long-term global licensing agreements with EIH Holdings Ltd (BVI) for The Oberoi and Trident brands under which EIH Holdings got exclusive rights to own and operate Oberoi and Trident hotels globally except India.

On December 16, 2013, Mossack Fonseca records show, Madhok confirmed that the reliable accounting records for J&W Inc were located at Level 3, Podium Building,120 Collins Street, Melbourne, which is also the address listed for EIH Holdings Ltd (BVI) in Australia. Oberoi and Madhok remained directors and Peran Limited (Hong Kong) held all 1,000 shares of J&W Inc.

In May 2008, a Sydney-based legal firm appointed by Madhok instructed that Mossack Fonseca’s invoices should be addressed to J&W Inc and “sent to and for the attention of Deepak Madhok and there should be a note on the invoice that it will be payable by EIH Holdings Ltd”, an Oberoi Group company.

On July 7, 2010, an Australian legal company, Aequus Counsel, sent a bunch of documents to Mossack Fonseca’s Bahamas office. Authorised by Madhok, the forwarding note described the transfer of 510 ordinary shares in J&W Inc to EIH International Limited while the attached form showed transfer of shares from Amex to Peran.

RESPONSE: In an email response to queries from The Indian Express, P R S Oberoi wrote on March 30: “It is a matter of public record that Oberoi Group and Amex Group had a joint venture for hotels and hotel management outside of India for many years. The joint venture was conducted primarily through EIH Holdings Ltd, a British Virgin Islands Company, although there were many companies involved in the joint venture because the joint venture was global, operated in many countries at different times and extended for a long period of time. The joint venture was terminated in 2010 through the purchase by Oberoi Group of Amex Group’s interest in the joint venture company and all controlled/affiliated entities. The entire reported consideration was paid solely to and for the benefit of Amex Group.

“Amex Group is a private partnership whose business affairs are not public. The business affairs of Amex Group/Oberoi Group joint venture are confidential and the parties are legally bound not to disclose or discuss those matters with third parties.

“Oberoi Group has taken all necessary approvals from the Government of India in relation to the Amex Group/Oberoi Group joint venture including the establishment, modification and termination of the joint venture.

“However, for the record, your numbered paragraphs 1-7 (of a questionnaire emailed by The Indian Express) contain statements of fact which are simply not correct, taken completely out of context. The various questions you pose are based not only on those incorrect assertions but other assumptions which are not valid. For the reasons mentioned, I cannot correct your errors.

“The private business affairs of Oberoi Group and its partners are not subject to review by media and public examination on demand.”

On April 1, a letter from Oberoi said: “Please understand that the entities and confidential transactions, events and documents your asserted statements of fact and questions relate to go back more than 10 years. Those entities and confidential transactions, events and documents are both complex and voluminous involving many parties, countries and entities all over the world. It is not possible to respond in a meaningful way, even if we were able to, without discussing a great deal more confidential information than the responses you seek or contemplate.

“The asserted statements of fact on which your questions are based are incorrect, taken out of context or predicated on invalid assumptions. To be absolutely clear, I neither confirm nor deny any asserted statements of fact on which your questions are based.”

Bhandari, according to sources in the IT Department, has admitted that the email trail recovered from his computer was that of messages exchanged between him, Vadra and Vadra’s assistant Manoj Arora. (Express photo: Oinam Anand)

Bhandari, according to sources in the IT Department, has admitted that the email trail recovered from his computer was that of messages exchanged between him, Vadra and Vadra’s assistant Manoj Arora. (Express photo: Oinam Anand) Confronted with the batch of emails, including one dated April 4, 2010 — the only one sent from Vadra’s own email ID and signed off by him — he acknowledged the exchanges on the subject of finalising interiors for a London apartment.

Confronted with the batch of emails, including one dated April 4, 2010 — the only one sent from Vadra’s own email ID and signed off by him — he acknowledged the exchanges on the subject of finalising interiors for a London apartment. In Tawang, Arunachal Pradesh, locals consider black-necked crane an embodiment of the 6th Dalai Lama. (Photo: Lham Tsering)

In Tawang, Arunachal Pradesh, locals consider black-necked crane an embodiment of the 6th Dalai Lama. (Photo: Lham Tsering)

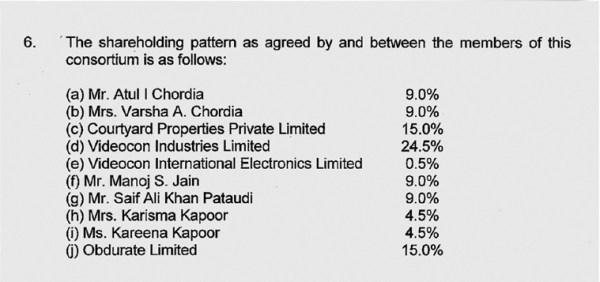

SHAREHOLDING – Vinod Adani and his wife as shareholders of GA International Inc (Bahamas)

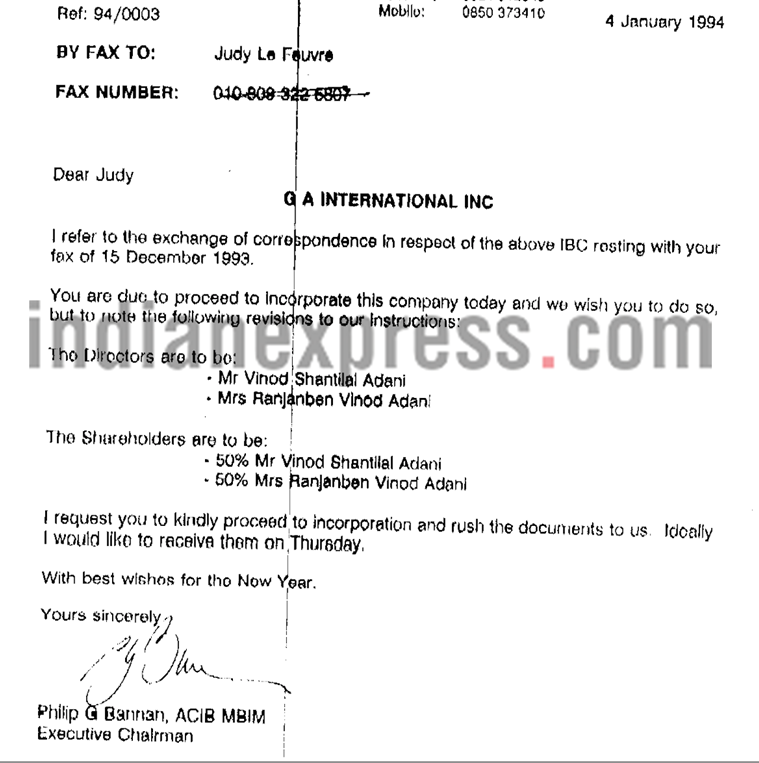

SHAREHOLDING – Vinod Adani and his wife as shareholders of GA International Inc (Bahamas) NAMECHANGE – Gautam Adani changed his surname to Shah on company records of GA International Inc (Bahamas)

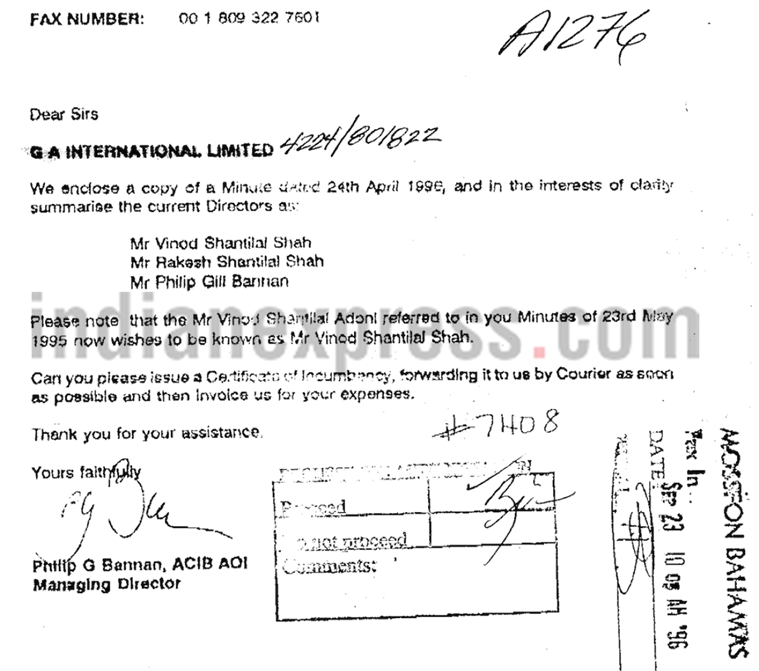

NAMECHANGE – Gautam Adani changed his surname to Shah on company records of GA International Inc (Bahamas) OVERWRITE – Adani replaced by Shah in company records of GA International Inc (Bahamas)

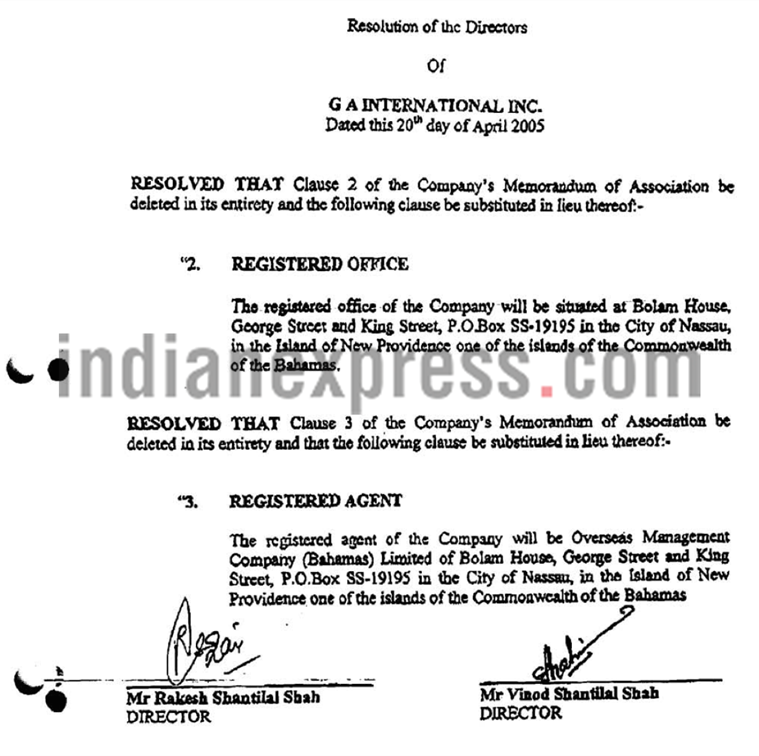

OVERWRITE – Adani replaced by Shah in company records of GA International Inc (Bahamas) SIGNATURES – Vinod and Rakesh Shah Adani signed as directors of GA International Inc (Bahamas)

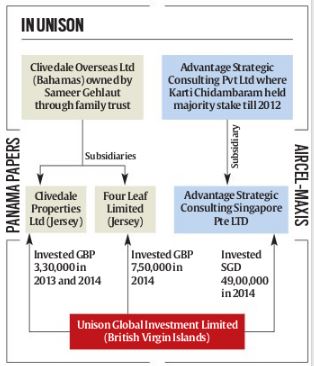

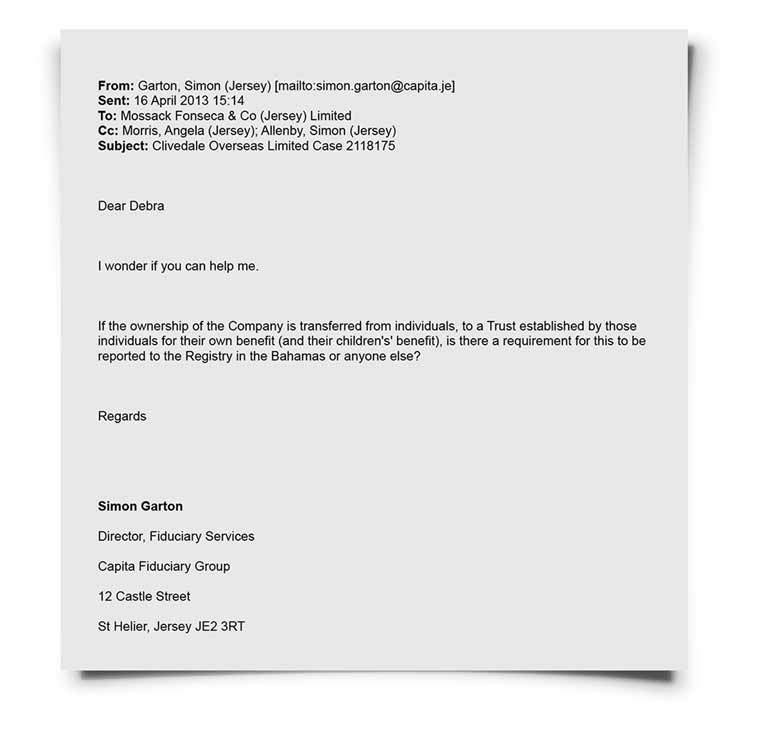

SIGNATURES – Vinod and Rakesh Shah Adani signed as directors of GA International Inc (Bahamas) An email to Mossack Fonseca on transferring the ownership of Clivedale (Bahamas) from individuals to “a Trust established by those individuals”.

An email to Mossack Fonseca on transferring the ownership of Clivedale (Bahamas) from individuals to “a Trust established by those individuals”.