Probing the Aircel Maxis case, the Enforcement Directorate (ED) sent a Letter Rogatory to Singapore this March for details on Advantage Strategic Consulting Singapore Pvt Ltd, a subsidiary of Advantage (India).

The Indian Express, 16 May 2016

The Indian Express, 16 May 2016

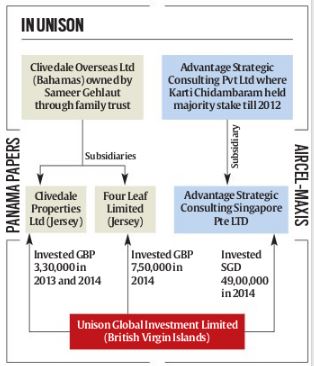

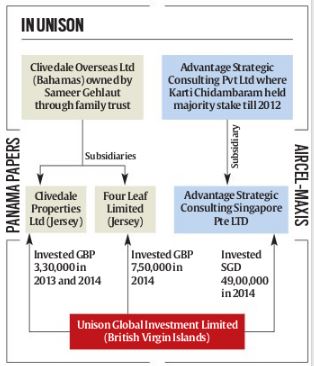

INVESTMENTS made by a mystery company set up in tax haven British Virgin Islands (BVI) are now the subject of scrutiny in two official investigations, in the Aircel Maxis case and the Panama Papers probe.

In 2013-2014, Unison Global Investment Limited, the BVI company, invested 1.08 million pounds in two Jersey companies owned or controlled ultimately by Indiabulls promoter Sameer Gehlaut.

During the same period, it also invested 2.4 million pounds in a Singapore company which is a subsidiary of Advantage Strategic Consulting Private Limited where Karti Chidambaram held a majority stake before exiting in 2012.

Probing the Aircel Maxis case, the Enforcement Directorate (ED) sent a Letter Rogatory to Singapore this March for details on Advantage Strategic Consulting Singapore Pvt Ltd, a subsidiary of Advantage (India).

A multi-agency committee appointed on the instructions of the Prime Minister, which includes Income Tax, RBI, ED and the Financial Intelligence Unit, is scrutinising details of all those named in the Panama Papers. At least two queries have been sent out to all those named and the RBI has asked each to furnish details of all remittances made overseas under the Liberalised Remittance Scheme (LRS).

Set up in December 2012, Unison Global Investment Limited is among the companies listed by ED whose links with Advantage (Singapore) are being investigated.

On December 15, 2014, according to Singapore registry records obtained by The Indian Express, Unison (BVI) was allotted 49,00,000 preference shares by Advantage (Singapore) for about 2.4 million pounds.

Records of this transaction list Unison (BVI) with a Singapore address (08-21 Peninsula Plaza) but identify the company as “Foreign Entity not registered with ACRA (Singapore’s Accounting and Corporate Regulatory Authority)”.

Records of bank transactions made by Unison in Advantage (Singapore) had the company’s BVI address: OMC Chambers, Wickhams Cay 1, Road Town, Tortola. This, according to BVI registry records, was Unison’s registered address until July 2014 when the company changed its address to PO Box 116, Road Town, Tortola.

Responding on behalf of Advantage Strategic Consulting Private Limited (India), a spokesperson said in an email: “All our transactions are reflected in our books. We are not aware of any unrelated third parties or transactions amongst them.”

When contacted, Karti Chidambaram said in an email: “I am neither a shareholder nor director of Advantage Strategic Consulting. I am not aware of any transactional details of the said companies.”

During 2010-2011, Ausbridge Holdings and Investments Pvt Ltd had bought 200,000 shares — amounting to a 66% equity stake — in Advantage Strategic. The 2011 annual return of Ausbridge Holdings shows that Karti Chidambaram owned 18,000 of the total 19,000 shares — 95% stake — in the company. In March 2012, Karti quit the directorship of Ausbridge and divested his stake.

Investigating the Aircel-Maxis scam, officials from the ED and the Income Tax department searched the offices of Karti Chidambaram in December 2015.

On March 7, former Home and Finance Minister P Chidambaram issued a statement on behalf of his family. “Karti runs a legitimate business, apart from managing inherited property. He has been an income tax assessee for many years. He has no undisclosed asset anywhere. If the Government is of the view that Mr Karti Chidambaram has undisclosed assets, I would ask the Government to make a list of such alleged undisclosed assets. Mr Karti Chidambaram will voluntarily execute any document necessary to transfer those assets (allegedly undisclosed) to the Government for a nominal consideration of Rupee 1,” it stated.

Besides investing in Advantage (Singapore), Unison (BVI) also invested 1.08 million pounds in three transactions between 2012 and 2014 to pick up 3,30,000 shares at 1 pound each and 7,50,000 shares at 1 pound each in two Jersey companies Clivedale Properties Limited and Four Leaf Limited respectively, according to annual returns filed by the Jersey companies.

According to Mossack Fonseca records that are part of the Panama Papers investigated by The Indian Express, these two Jersey companies belong to Clivedale Overseas Limited (Bahamas), owned by Sameer Gehlaut, the promoter of the Indiabulls Group, through a family trust.

Said Suresh Jain, responding on behalf of Sameer Gehlaut, in an email: “Unison is owned by family office of a foreign national. Unison has made private equity investment of 11% in Clivedale Properties Ltd., that is undertaking development project — Mansion at 9 Marylebone Lane. We are bound by confidentiality clause in the agreement of investment.”

According to records obtained from the BVI registry by The Indian Express, Unison (BVI) also entered into an agreement “in relation to the capital of Clivedale Properties” with HSBC Bank plc (London) in December 2014 and pledged its 3,30,000 shares of Clivedale Properties as collateral.

And in December 2015, Unison (BVI) entered into another agreement with Qatar National Bank SAQ (London) for the development of 4, 5, 6 Stanhope Gate and 18A and 18B Curzon Street, London, the Mayfair Park properties owned and being developed by Clivedale Overseas (Bahamas) through its subsidiaries. The secured liabilities were the Four Leaf’s 7,50,000 shares held by Unison (BVI).

No comments:

Post a Comment